How to calculate markup

To succeed as a contractor, you must price jobs so that they cover your labor costs, materials and overhead expenses, and still make a decent profit. You don’t want to charge too much and risk losing jobs, and you don’t want to work for free because you didn’t charge enough. If you know how to calculate markup correctly, you can apply it to your job costs to find the right price for your work.

Determining the markup you should apply to your work can be challenging as many of the numbers you use will change. However, calculating a markup percentage is the only way you can be sure you’ll cover your costs and make a profit on the work you do.

Before calculating the correct markup percentage for your business, you need to know:

- Your estimated total overhead expense for the year

- Your anticipated total revenue for the year

- How much profit you want to make on that total revenue

Overhead expenses are indirect job-related expenses you incur that cannot be charged to a specific job. If a cost can be charged to a job, it should be included in your project estimate as a job cost in the same way as material or labor.

How to calculate markup

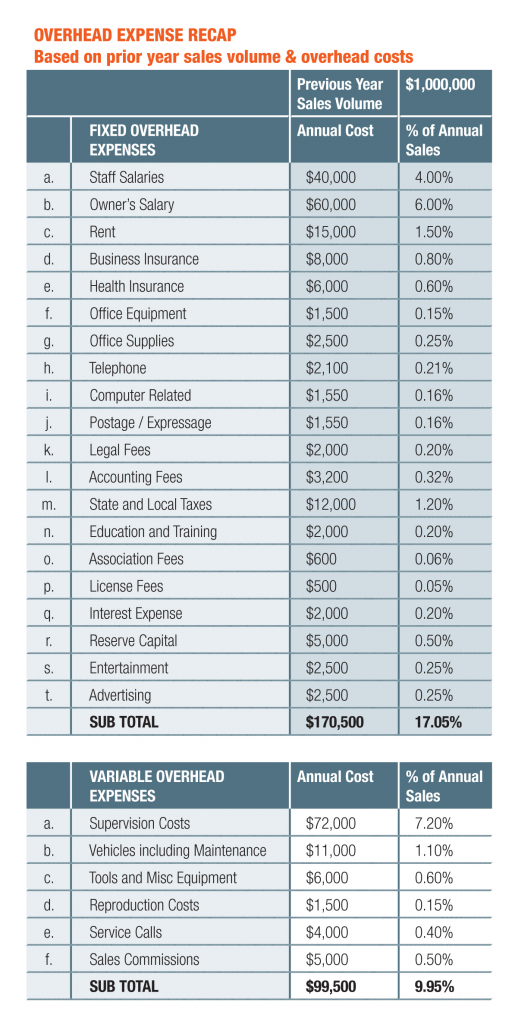

Begin by dividing overhead into two categories – fixed and variable. Examples of fixed overhead are rent, utility costs, office salaries, annual fees for licenses, insurance premiums and any other regularly occurring cost. Variable overhead includes project supervision costs, tools and equipment purchases, and sales commissions or bonuses – costs that vary with the volume of work. Capture these costs as accurately as possible. If you have been in business for some time, you can use your historical costs to get an accurate annual overhead cost.

The chart lists typical overhead categories and values. Use it as a guide to help you calculate your approximate overhead costs and to be sure you include everything. (Note: Different types of contractors have different overhead costs, so you should adjust the items to match your business expenses.) In the chart, you can see this company had $1 million in sales the previous year, fixed overhead costs of $170,500 (17 percent of sales), and variable overhead costs of $99,500 — almost 10 percent of sales.

To calculate markup, estimate your revenue or sales volume for the coming year. For this example, we will use an estimated sales volume of $1,250,000. Next, determine how much profit you need to make on that sales volume. For this example, we will use a profit of 6 percent.

Finally, using the historical (or estimated) costs for the prior year’s fixed and variable overhead and the profit you’d like to make, we can calculate an accurate markup percentage:

Fixed overhead costs = $170,500

Variable overhead costs = ($1,250,000 x 10%) or $125,000

Profit = ($1,250,000 x 6 %) or $75,000

Total job cost = $370,500

Deduct that total from your sales volume estimate.

$1,250,000 – $370,500 = $879,500

Your markup is determined by dividing total sales volume by total job cost.

$1,250,000/$879,500 = 1.42 or 42%

In other words, if you estimate your job costs accurately and apply a markup of 42 percent, you should cover your job costs and overhead costs and still achieve your profit goal.

Your numbers will change, of course, if you don’t reach your sales volume for the year. Be sure to review your actual costs and sales volume at the end of each quarter so you can adjust your markup based on your company’s actual performance.

Different markup methods

This method of determining markup is called a “uniform” or “across-the-board” markup, and while it is easier to calculate, it may not provide enough flexibility for your business. Other types of markup you may want to use include:

- Differential markup, which is used by most general contractors and is based on marking up different cost categories individually. With a differential markup, your estimated labor costs, material costs, and subcontracted work costs would each be assigned a different markup. The aggregate total of all markup earned must total your estimated overhead and profit.

- Labor markup is used by companies that primarily supply labor and do not typically subcontract the work. For example, if you employ four tradesmen 2,000 hours per year or 8,000 total hours, and you need to earn $200,000 of gross profit (overhead costs + net profit), you must charge an additional $25 per hour over and above your actual hourly labor cost for all hours worked ($200,000/8,000 = $25).

Regardless of which markup method you apply, the benefits of regularly reviewing your overhead costs can’t be over-emphasized for a small business owner.

Negotiating your markup

Avoid lowering your markup because you think you know what the owner wants to spend or what other contractors are charging for similar work. Instead try to negotiate what you are going to do, how you are going to do it, and when you are going to do it – not how much you are going to charge. Your selling price must be based on your calculated overhead costs and profit goals, and if you reduce the markup you will be losing money right out of the box and trying to make up that loss on other projects.

You can’t make money if you don’t know your costs. Read “Estimate every job” at MiConstruGuia.com.

–By Bruce Webb, general contractor